Fields of activity

Data Analysis in Audits

The so-called Journal Entry Testing (JET) should be part of every annual audit. Both international auditing standards (ISA) and german profession pronouncements (IDW PS) on the proper performance of annual audits emphasize data analyses (in particular journal entry testing) as an efficient and effective audit procedure for obtaining sufficient and appropriate audit evidence at various points.

Without a corresponding journal entry testing, the professional requirements for an adequate examination and audit documentation are hard to achieve.

Journal entry testing is performed in the auditor’s “response” to the following significant risks assumed by the auditing standards:

- Risk of material misstatement due to sales realization violations (IDW PS 210, Tz. 39; ISA 240.26)

- Possibility for management to override controls („Management-Override“) (ISA 240.31; IDW PS 210, Tz. 43)

- Significant transactions with related parties that occur outside the ordinary course of business (ISA 550.18 i.V.m. 23; IDW PS 255, Tz. 20a).

- Risks of material misrepresentations due to violations (ISA 240.27; IDW PS 210, Tz. 38)

- Consideration of Fraud in a Financial Statement Audit (SAS 99, Statement on Auditing Standards No. 99)

Due to statutory regulations (in particular § 317 HGB), external auditors also must perform comprehensive audit procedures for other internal control system components such as IT-based accounting systems (IDW PS 261, Tz. 35-36, IDW PS 300, IDW PH 9.330.2).

Our Journal Entry Testing Service for Your Annual Audits

It is crucial to consider Journal Entry Testing already in the planning phase of an annual audit. Since we understand ourselves as an interdisciplinary team consisting of accountants and data analysts, we can support you already in your annual audit planning phase.

Technical Know How various systems

We have successfully completed Journal Entry Testings with a variety of systems

Comprehensive, field-tested analyses

The analyses were applied to more than 300 Journal Entry Testings

Fast processing

Thanks to automated processing, the results of the Journal Entry Testing are available in 1-3 days

Fixed price

We offer you a fixed price based on the scope of the necessary data analyses and the budget for your annual audit.

| Analysis | Short Description | Example |

|---|---|---|

| Overview of Multiple Conspicuous Documents | List of all documents/ postings from the audit period that was identified as conspicuous by several analyses | |

| Accounts Overview | Listing of all accounts booked during the audit period including the number of line items and the booking volume | |

| User Overview | List of all UserIDs with which bookings were made during the audit period, including the number of line items and the posting volume | |

| User with few postings | List of document items for UserIDs that posted little in the period under review | |

| Documents für selected UserIDs | List of document items posted by selected UserIDs in the audit period (for example, IT employees, collective accounts) | |

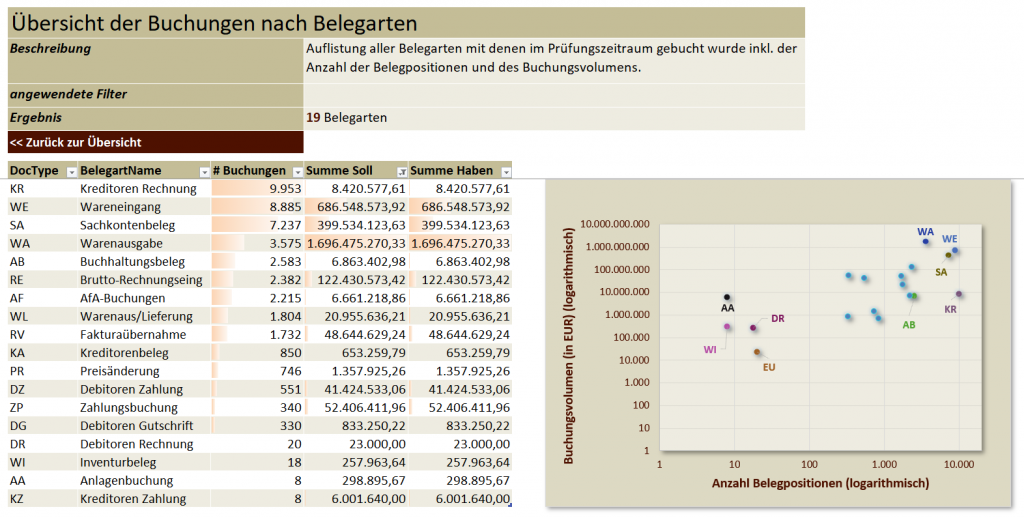

| Overview of Document Types | List of all document types with which postings were made during the audit period, including the number of line items and the posting volume | |

| Segregation of Duties | ||

| Posted document types per User | List of document types used by each user | |

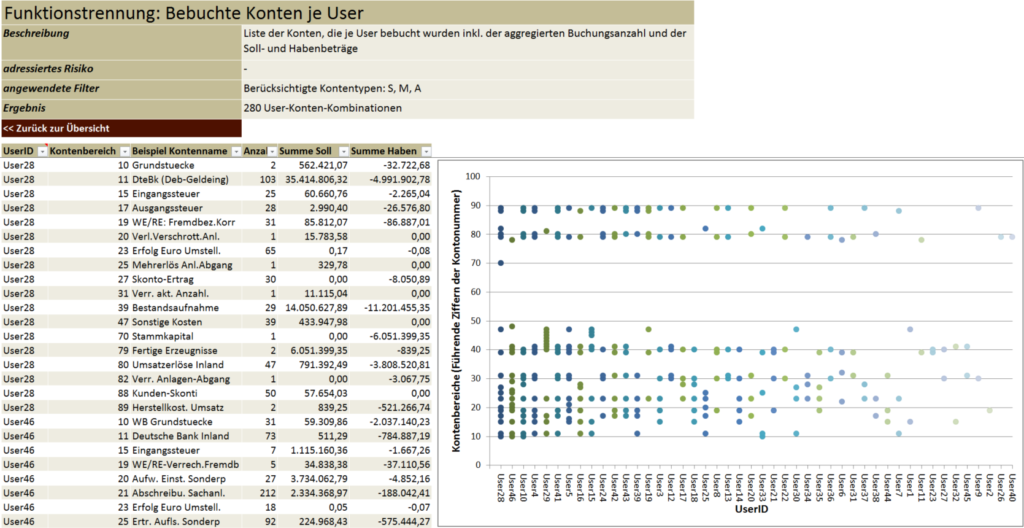

| Posted accounts per User | List of the accounts posted to for each user, including the aggregated number of postings and the debit and credit amounts | |

| Unusual Postings | ||

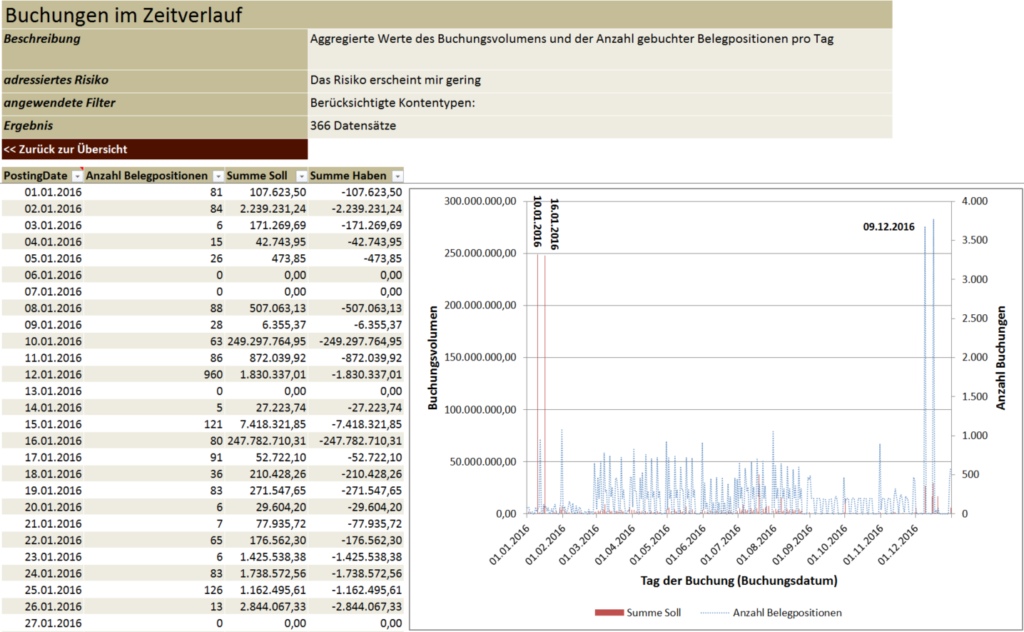

| Posting History | Aggregated values of the posting volume and the number of posted line items per day | |

| Large Amounts | List of posting items with the largest amounts | |

| Round Amounts | List of posting items with round amounts | |

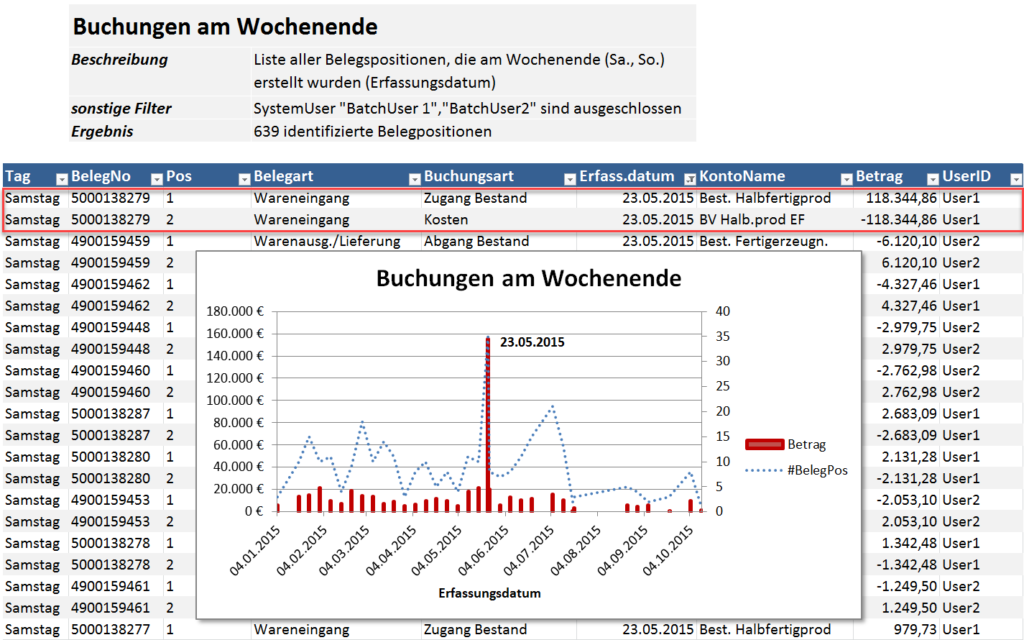

| Postings on Weekend/ Holidays | List of all line items that were recorded on weekends (Sat, Sun) or holidays (based on the entry date) | |

| Critical document texts | List of all documents containing critical words in the document texts | |

| Benford Analysis | Overview of the frequency of leading digits in the amounts compared to the frequencies expected according to the Benford distribution | |

| Postings for conspicuous Benforder amounts | List of all line items that contain leading digits for the amounts that were identified as conspicuous in the Benford analysis | |

| Generally Accepted Accounting Principles | ||

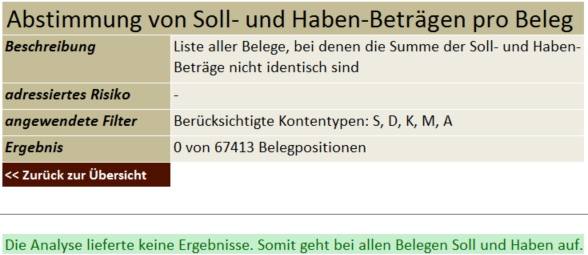

| Reconciliation of debit and credit per document | List of all documents for which the total of the debit and credit amounts are not identical | |

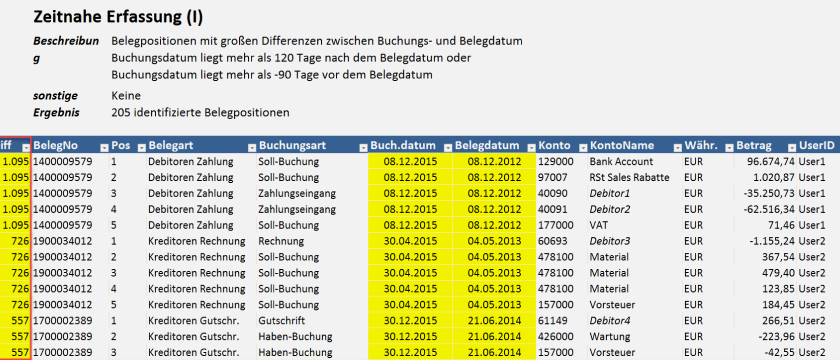

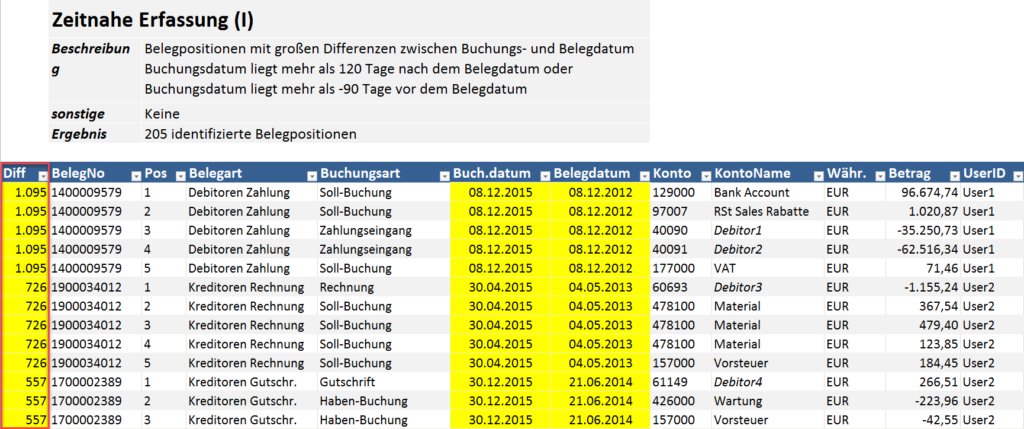

| Timely Recording (I) | List of line items with large differences between the posting date and the document date | |

| Cut Off (I) | List of line items with a posting date in the fiscal year and a document date after the end of the fiscal year | |

| Cut Off (II) | List of line items with a posting date in the fiscal year and an entry date after the end of the fiscal year |

Quality and Efficiency through Journal Entry Testing

Due to the progressive use of IT systems in companies, the volume of audit-relevant data is continuously increasing. Business transactions are increasingly recorded and processed exclusively electronically. Here, Journal Entry Testing helps expand the scope and detail of audit procedures without increasing their complexity.

The term data analysis in the context of annual audits (particularly Journal Entry Testing) describes the targeted and IT-supported selection, preparation, and evaluation of accounting-relevant data to obtain appropriate audit evidence (IDW PH 9.330.3). As auditors, they enable you to effectively and efficiently carry out audit procedures based on the risk-oriented audit approach. You can use data analysis throughout the whole audit process.

- Identification of error risks and irregularities (e.g., identification of unusual postings with regard to entry date/time and persons, offsetting account analysis)

- Assessment of the control environment and the effectiveness of implemented controls (e.g., amounts double-recorded, bookings by persons outside your competencies)

- Statement-based audit procedures and case-by-case reviews at transactional, account, and financial statement level (e.g., monthly revenue per unit)

Our Approach for Your Journal Entry Testing

However, the hurdles to conducting data analysis are high. Not all audit firms have the technical know-how (data export, preparation of the data) and the time to carry out comprehensive data analyses. Here our automated analysis approach helps. You do not have to deal with the netty technical details. You get the results in an Excel-based format that makes it easy for you to process and document the performed audit procedures. So you can concentrate on the business aspects of your audit steps.

Our approach considers the Institute for Auditors (IDW) requirements for the use of data analysis in annual audits (IDW PH 9.330.3). We can cover a wide range of financial accounting and ERP systems.

1) Target definition of the Journal Entry Testing

Audit standard-compliant scope of analyses (indicators): With our standard set of indicators implemented in our Journal Entry Testing Software, we cover most common booking journal-based analyses, listed in corresponding audit standards (IDW PS 210, ISA 240, SAS 99, IDW PH 9.330.3) .

Individual analyses: Also, we can extend the set of indicators of your Journal Entry Testing by further customized analyses, taking your audit approach into account, to specifically address particular error risks of your clients.

Information we need: Audit period, the scope of accounts (analysis of all financial accounts or analysis of selected financial accounts), materiality, preliminary risk evaluation for individual analyses.

2) Data acquisition for the Journal Entry Testing

We coordinate the data export with you or directly with your client based on the objectives set. No special technical knowledge from your side is necessary here. Your client’s data is encrypted and transferred to our IT infrastructure. Upon data import, we reconcile it with the balance sheet/ income statement to ensure the completeness and integrity of the data provided.

Information we need: If necessary, contact person at client, balance sheet/ income statement for reconciling the dataset.

3) Execution of the Journal Entry Testing

We perform the analyses on our IT system. Of course, the system meets the high IT security requirements of an auditing company. Our automated processing chain enables us to prepare the analyses, as a rule, within one working day after receiving the data.

4) Interpretation and Documentation of the Results

Contact us for Your Journal Entry Testing

Error: Contact form not found.